OP-ED: Rethinking Africa’s climate finance future

Nchedolisa Akuma tackles Africa's climate finance challenges, advocating for more assertive strategies to drive innovation and environmental resilience.

A few weeks ago, my wife Sithabiso and I embarked on a multi-day hike along the Limestone Way, a 74-kilometre trail winding through the idyllic White Peak landscape of the Peak District National Park in central England. Our wanderings offered a heady mix of rich British history, picture-book natural beauty and lovely late summer weather—until the very last day of our adventure, when the UK decided to tax our pleasures with a proper soaking.

Despite all that pleasantness, we couldn’t ignore the sobering effects of centuries of grazing, monoculture, mining, encroaching urban development and, perhaps most notably, climate change on the English countryside. It served as a reminder that not all industrial practices should be adopted indiscriminately, particularly in less touched parts of the world.

The fact is, very few millennials like myself, who either lived or holidayed in pristine wilderness or relatively sustainably-worked rural farmlands during their upbringing in Africa, can today visit those places without experiencing a profound heartache and sense of loss. The effects of just a few decades of Western- (and Eastern-) inspired industrialisation have marred much of the green(er) memories of our early years.

Meet Nchedolisa Akuma

Nchedolisa Akuma, a finance professional whose childhood in Nigeria was worlds apart from my own in Zimbabwe, shares a similar sense of heartache. Akuma has built solid experience in market research, financial analysis and navigating Africa’s financial ecosystem. She’s sharpened her skills working with major players like Interswitch and consulting for Accenture. Along the way, she’s worked with banks and fintechs, specialising in assessing financial performance, building models, and spotting investment opportunities for private equity firms, investment banks and venture capital funds.

After attending countless industry conferences and webinars where the climate crisis was dismissed as a niche concern for 'sleepy agriculturalists' rather than serious financiers, Akuma has become determined to tackle what she sees as a giant elephant in the room. Her passion for climate finance goes beyond addressing intellectual dishonesty, though. It’s rooted in her experience growing up in Nigeria, where the abuses of international oil have ravaged rivers and natural landscapes. Witnessing this environmental degradation first-hand has fuelled her commitment to ensuring that finance becomes a force for positive change.

Akuma is determined to flip the script on this issue. She’s now on a mission to bring climate considerations into the mainstream of the financial industry, convinced that finance isn’t just about profit—it’s equally about crafting smart economic solutions to better steward the planet.

The environmental and industrial shifts affecting the continent present a complex backdrop for Africa’s tech and innovation landscape. Akuma senses an urgent need for innovative and strategic approaches that can effectively platform and drive critical climate-focused tech adoption, among other interventions. Yet, progress may be hindered by poor or ineffective policymaking and investment strategies that lack creativity and relevance.

Here’s what's on Akuma’s mind, in her words:

Dealt an unfair hand

It seems wholly unfair that Africa, already grappling with a long list of fiscal, social, economic, and political woes, must now face climate change as well. The evidence is clear: developed economies have driven us into this mess. In 2021, Africa’s share of global CO2 emissions was a mere 3.8%. Yet, the harsh reality is that climate change knows no borders and respects no one.

The frequency of climate-related disasters in Africa has surged dramatically. In the 1970s, there were only 85 recorded climate events on the continent; by 2019, that number had risen to over 540. In 2022 alone, more than 110 million Africans were directly impacted by weather, climate, and water-related hazards, leading to over $8.5 billion in economic damages. The bottom line is simple: a warming planet will not be kind to Africa.

It’s no wonder African leaders, such as Kenya’s President William Ruto and the President of the African Development Bank (AfDB) Akinwumi Adesina, are sounding the alarm and demanding financial support from the Global North. Africa needs significant backing in its climate adaptation and mitigation efforts. The numbers are staggering. The AfDB estimates that Africa will need between $1.3 trillion and $1.6 trillion over the next decade to implement its climate action commitments. That’s an annual financing gap of approximately $99.9 billion to $127.2 billion.

Manna from above

However, waiting for help from developed nations is like searching for water in the desert. Take the Green Climate Fund (GCF), one of the largest multilateral funds aimed at helping developing countries respond to climate change. As of 2024, only $4.4 billion of the $13.9 billion in approved projects had been disbursed.

That’s not to say there hasn’t been progress. Indeed, there is a growing pool of climate finance capital. Funds like the GCF, the Climate Investment Funds, and the Adaptation Fund have brought much-needed liquidity into global climate finance. However, relying on the goodwill of the Global North is not a sustainable strategy for Africa. African policymakers must shift their focus to positioning Africa as a competitive player in the global climate finance market. The goal should be to attract funding while simultaneously reshaping the global climate finance infrastructure to better serve Africa’s unique context.

Taking the bull by the horns

The first step is for African governments to address the continent’s self-inflicted challenges. Currency risks, for example, are a major barrier. African economies are struggling with debt distress, high interest rates, and inflation—all of which weaken their currencies. To attract international private capital, Africa must create an enabling environment for FX hedging solutions, as recommended by the Climate Policy Initiative. This means improving macroeconomic stability and facilitating the development of financial instruments that can protect against currency volatility.

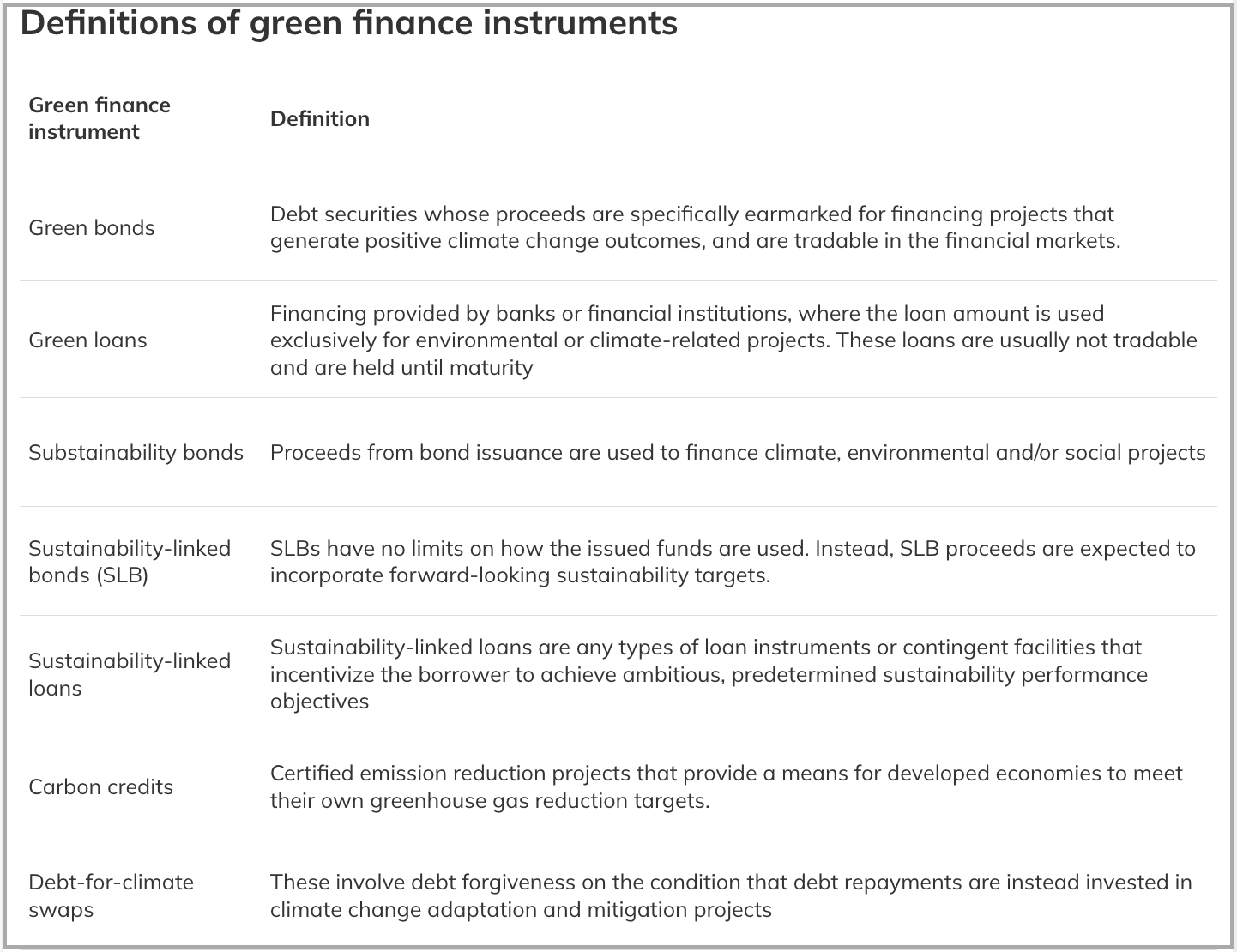

But it’s not just about fixing internal issues. The global climate finance infrastructure itself must be upgraded to work for Africa. While there has been significant innovation in green financing instruments - such as green bonds, sustainability-linked loans, and carbon markets - these tools have largely been developed in the Global North and carry inherent biases against African markets.

For one, much of the available climate finance is geared towards mitigation rather than adaptation. A 2023 report by the United Nation’s Intergovernmental Panel on Climate Change (IPCC) highlights that over 90% of climate finance is allocated to mitigation activities, even though adaptation is where Africa’s needs are most pressing. Africa’s vulnerability to climate change means adapting to its effects should be the priority, not merely mitigating future emissions. It is encouraging, however, that the Green Climate Fund aims to devote 50% of funding to adaptation projects.

Furthermore, these financing instruments are designed for markets with more advanced, sophisticated SMEs and often overlook Africa’s high level of informality in entrepreneurial sectors. Agriculture, for example, contributes 20% to greenhouse gas emissions. Yet, informal, small-scale farmers, who produce up to 80% of the food in developing countries, receive less than 1.7% of global climate finance. The byzantine maze of compliance and reporting standards adds to these access barriers. Most African SMEs struggle to keep up with the ever-growing alphabet soup of standards—TCFD, TNFD, and SDG reporting- adding another hurdle to accessing much-needed climate funding.

Africa can no longer afford to wait for the world to act. While African governments must continue advocating for a global climate finance infrastructure that truly serves the continent's needs, they must simultaneously create an enabling environment to attract innovative climate funding. It’s time for Africa to turn its climate challenges into a compelling investment case for the world.

Editorial Note: A version of this opinion editorial was first published by Business Report on 10 September 2024.